To itemize or not to itemize. Here are the new standard deductions to help you decide.

It is important to understand what a standard deduction is. Under United States tax law, the standard deduction is a dollar amount that non-itemizers may subtract from their income before income tax is applied. Taxpayers may choose either itemized deductions or choose the standard deduction, but usually choose whichever results in the lesser amount of tax payable

,The standard deduction in 2017 was $6500 for a single taxpayer and each taxpayer was eligible to claim an exemption of $4050 which added together equals $10,550. That means that each taxpayer can deduct $10,550 from their income and what is left over is what they owed taxes on.

An example for a standard deduction in 2017:

Joe is a single taxpayer with no children, no property, and no other deduction who makes $30,000 in 2017.

An example of itemizing deductions in 2017:

Bob is a single taxpayer who owns a house, had lots of medical bills, and lots of unreimbursed employee expenses who also made $30,000 in 2017. His property taxes were $5500, his medical bills that he is able to deduct is $7500, and his unreimbursed employee expenses were $3000.

What will Joe pay in taxes in 2018?

The new changes for 2018 are explained further below. The new standard deduction in 2018 for a single filer is $12,000 but the personal exemption has been eliminated. So let's take a look at how that will affect Joe's 2018 taxes.

Joe is a single taxpayer with no children, no property, and no other deduction who makes $30,000 in 2017.

- $30,000 - $10,550 = $19,450

An example of itemizing deductions in 2017:

Bob is a single taxpayer who owns a house, had lots of medical bills, and lots of unreimbursed employee expenses who also made $30,000 in 2017. His property taxes were $5500, his medical bills that he is able to deduct is $7500, and his unreimbursed employee expenses were $3000.

- $30,000 - ($5500 + $7500 + $3000) = $14,000

What will Joe pay in taxes in 2018?

The new changes for 2018 are explained further below. The new standard deduction in 2018 for a single filer is $12,000 but the personal exemption has been eliminated. So let's take a look at how that will affect Joe's 2018 taxes.

- $30,000 - $12,000 = $18,000

What has changed in 2018?

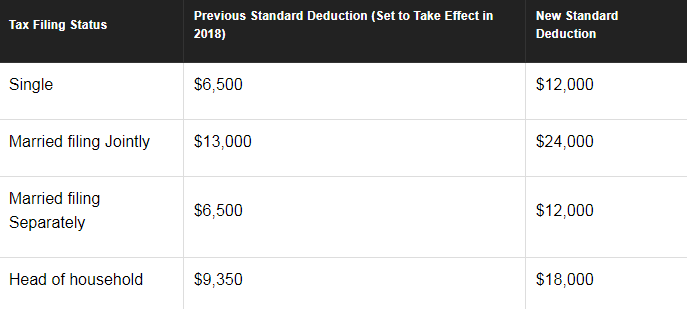

There are significant changes to the standard deductions under the Tax Cuts and Jobs Act (TCJA). Look at the chart below.

The standard deduction has roughly "doubled" for all filers, but the valuable personal exemptions have been eliminated. In the examples above, a single filer in 2017 was entitled to a standard deduction of $6500 PLUS the personal exemption of $4050 which totaled $10,550. So while the new standard deduction is slightly higher, it is not necessarily doubled.

How does this affect your taxes?

Like many Americans, you might be wondering how this will affect your taxes. Before the TCJA, taxpayers could claim personal exemption for themselves, their spouse, and their eligible dependents. Each personal and dependent exemption lowered taxable income by $4,050 prior to the new changes in the tax laws. The new law has eliminated all personal and dependent exemptions for tax years 2018-2025.

So let's take a look at another example:

Bill and Jane have 4 children and are filing jointly. In 2017, they were able to deduct $13,000 (married filing jointly) for themselves for the standard deduction and each of them were entitled to the $4050 exemption to total $8100. ADDITIONALLY they were able to deduct $4050 for each of their 4 eligible children ($4050 x 4) to equal $16,200. If their combined income in 2017 was $150,000 and they only took the standard deduction, here's how much they were able to deduct from their income.

Let's look to see how Bill and Jane's taxes change in 2018:

They still have 4 eligible dependents and combined they both still made $150,000. However, they can no longer claim the $4050 exemption for themselves and their dependents, but they have a higher standard deduction.

So let's take a look at another example:

Bill and Jane have 4 children and are filing jointly. In 2017, they were able to deduct $13,000 (married filing jointly) for themselves for the standard deduction and each of them were entitled to the $4050 exemption to total $8100. ADDITIONALLY they were able to deduct $4050 for each of their 4 eligible children ($4050 x 4) to equal $16,200. If their combined income in 2017 was $150,000 and they only took the standard deduction, here's how much they were able to deduct from their income.

- $150,000 - ($13,000 + $8100 + $16,200) = $112,700

Let's look to see how Bill and Jane's taxes change in 2018:

They still have 4 eligible dependents and combined they both still made $150,000. However, they can no longer claim the $4050 exemption for themselves and their dependents, but they have a higher standard deduction.

- $150,000 - $24,000 = $126,000

From the example above, Bill and Jane owe more taxes in 2018 because they lost the ability to claim the exemptions on their dependents. So how will this affect you, the taxpayer? If you are only claiming the standard deduction, with little or no dependents, then you should be paying less taxes (or getting a higher refund) under the new tax laws.

If you have a lot of dependents, then you may find yourself paying more taxes (or getting less of a refund) under the new tax laws.

Need help navigating these new laws? Let us help you prepare your taxes. Call us today!

If you have a lot of dependents, then you may find yourself paying more taxes (or getting less of a refund) under the new tax laws.

Need help navigating these new laws? Let us help you prepare your taxes. Call us today!